pa auto sales tax rate

After the title is transferred the seller must remove the license plate. The Pennsylvania sales tax rate is currently 6.

How To Register For A Sales Tax Permit Taxjar

At PA Auto Sales we finance everyone.

. Average Local State Sales Tax. The motor vehicle sales tax rate is 6 percent the same as on other items subject to sales tax plus an additional 1 percent local sales tax for vehicles registered in Allegheny. Pennsylvanias sales and use tax rate is 6 percent.

The use tax rate is the same as the sales tax rate. PA Sales Use and Hotel Occupancy Tax. Effective October 30 2017 a prorated partial day fee for carsharing services was.

Pennsylvania charges a flat rate of 6 sales tax on most vehicle purchases in the state. 6 percent state tax plus an additional 1 percent local tax for items purchased in delivered to or used in Allegheny County and 2 percent local. Sales tax rate decreased from 5125 to 5 as of July 1 2022.

Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate. The car sales tax in Pennsylvania is 6 of the purchase price or the current market value of the vehicle according to the PennDOT facts sheet. This is the total of state county and city sales tax rates.

The state county or municipalities can also add specialty taxes. When purchasing or selling used vehicles including motorcycles in Pennsylvania many taxpayers are unaware that sales tax due to the Department of Revenue is a percentage of the. The county the vehicle is registered in.

Call Sales Phone Number 215-330-0539 Service. Nine-digit Federal Employer Identification. 775 for vehicle over.

260 per pack of 20 cigaretteslittle cigars. Eight-digit Sales Tax Account ID Number. Combined with the state sales tax the highest sales tax rate in Pennsylvania is 8 in the cities of Philadelphia Bensalem Glenside Feasterville Trevose and Lansdowne and seven other cities.

The VRT is separate from and in addition to any applicable state or local Sales Tax or the 2 daily PTA fee. Pennsylvania State Sales Tax. The sales tax rate for Allegheny County is 7.

The minimum combined 2022 sales tax rate for Easton Pennsylvania is 6. 9 New York - Does not grant credit for sales tax paid to Pennsylvania on motor vehicles. Tax and Tags Calculator.

Well get you in the perfect car truck or SUV for your lifestyle. Additionally the state allows local jurisdictions to add additional sales tax. 635 for vehicle 50k or less.

The seller must indicate the mileage of the vehicle in the appropriate spaces provided on the ownership document. 10 North Carolina -. With local taxes the total sales tax rate is between 6000 and.

For instance if your new car costs. The following is what you will need to use TeleFile for salesuse tax. 1 percent for Allegheny County 2 percent for Philadelphia.

31 rows Pennsylvania PA Sales Tax Rates by City The state sales tax rate in Pennsylvania is 6000. Maximum Possible Sales Tax. Residents in Allegheny County though pay 7 tax and those in the city Philadelphia pay.

When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. Maximum Local Sales Tax. Pennsylvania collects a 6 state sales tax rate on the purchase of all vehicles with the exception of Allegheny County and the City of Philadelphia.

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

States With The Highest And Lowest Sales Taxes

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Sales Tax Calculator And Rate Lookup Tool Avalara

Selling To A Dealer Taxes And Other Considerations News Cars Com

Pennsylvania 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Georgia Used Car Sales Tax Fees

What S The Car Sales Tax In Each State Find The Best Car Price

Understanding California S Sales Tax

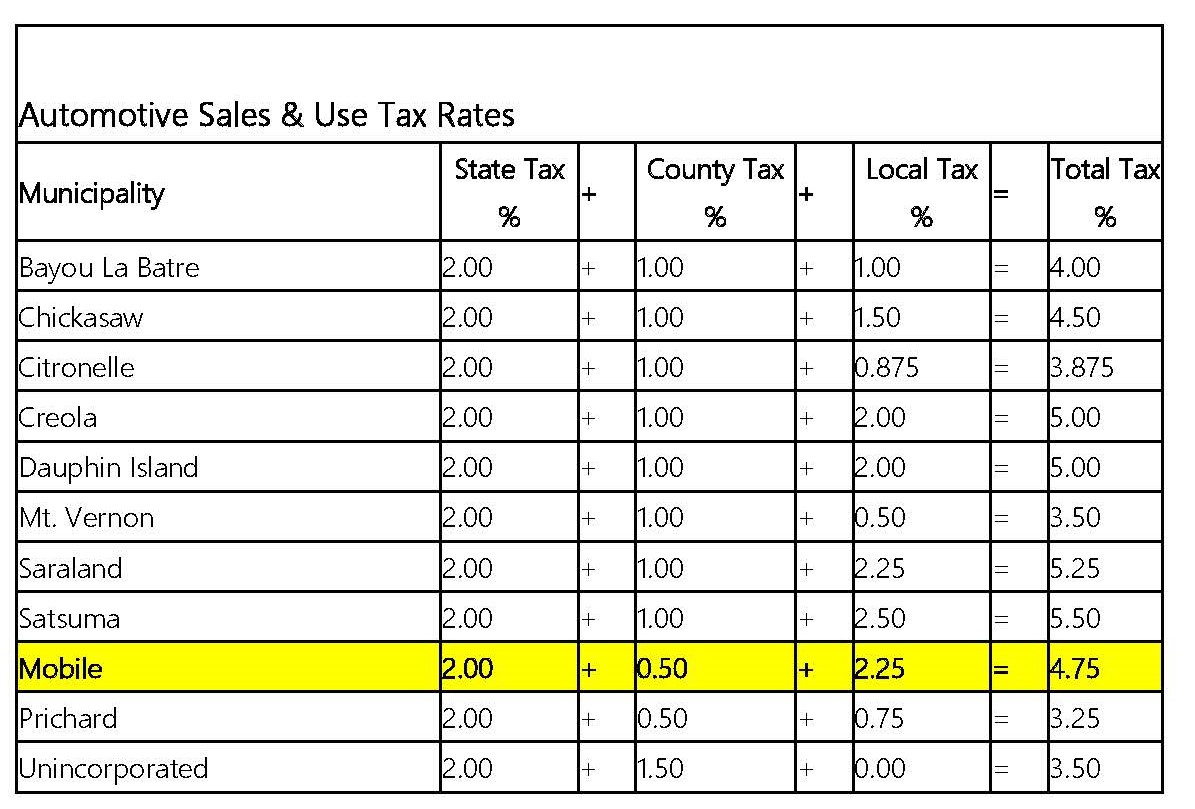

Taxes Mobile Area Chamber Of Commerce

Car Tax By State Usa Manual Car Sales Tax Calculator

Local Sales Tax Rates Tax Policy Center

What New Car Fees Should You Pay Edmunds

Pennsylvania Property Tax H R Block

Can I Avoid Paying Sales Taxes On Used Cars Phil Long Dealerships

Vehicle Sales Tax Deduction H R Block

What Are The Vehicle Registration Taxes Fees In Pennsylvania Tri County Toyota